What Is Payday Super?

Starting 1st July 2026, superannuation payments will move to a new rhythm. Instead of paying quarterly, employers will need to pay super at the same time as wages. Every pay run will now include a corresponding super contribution. The goal is to speed up payments and reduce the billions of dollars in unpaid or late payments each year. For Bookkeepers and BAS Agents, this represents a significant change, requiring new processes, more frequent reconciliations, and careful attention to payroll systems. This change means reconciliation of super contributions will happen every pay run instead of quarterly, requiring bookkeepers to monitor each payroll closely to ensure accuracy and timeliness

What It Means for Employers

The government’s Payday Super reform is now law and will take effect from 1st July 2026. This means employers will be required to pay their employees’ superannuation at the same time as their salary and wages.

Business owners should start preparing now to ensure a smooth transition to Payday Super. Early action will help your business stay compliant, manage cash flow effectively, and avoid unnecessary pressure as the start date approaches.

What is Payday Super & Qualifying Earnings

Payday Super is a change to how employers pay superannuation. From 1st July 2026, employers will be required to pay super at the same time as wages. (This means if an employee is paid weekly, fortnightly, or monthly, the employer must calculate and pay their superannuation each time they are paid.

From 1st July 2026, the Superannuation Guarantee (SG) rate is 12% of an employee’s Qualifying Earnings. The amount of super is based on Qualifying Earnings (QE). This is the portion of an employee’s pay that counts for super purposes. It includes:

- Ordinary wages and salary for hours worked.

- Shift loadings and allowances.

- Certain bonuses that form part of regular pay.

- Commissions, including some paid for work outside ordinary hours.

- Salary sacrifice contributions to super, where the sacrificed amount would have otherwise been QE.

- Payments to workers under the expanded definition of employees, such as independent contractors paid mainly for their labour, artists, musicians, sportspersons, and statutory office holders.

What Does Not Count as QE:

- Most overtime payments unless ordinary hours are not clearly identifiable.

- Certain one-off or ex gratia payments. Payday Super Guidance © The Institute of Certified Bookkeepers (November 2025) Page 2

- Paid parental leave, except amounts that would otherwise be QE.

- Termination payments, including redundancy payments (unless in lieu of notice).

- Certain leave, such as community service, jury duty, or defence reserve leave.

- Salary sacrificed amounts for benefits other than super.

Source: ATO – What payments are qualifying earnings (QC105843)

The ATO has also introduced a draft Practical Compliance Guideline (PCG 2025/D5) outlining its approach to compliance during the first year of Payday Super.

The ATO intends to focus its compliance efforts on employers who fail to pay the minimum SG contributions and do not take prompt action to rectify any issues. Employers who make genuine efforts to comply and resolve issues quickly are less likely to face compliance action.

How It Will Work

- Super contributions must reach the fund within seven calendar days of payday.

- Reporting will continue through Single Touch Payroll (STP), which links payroll and super reporting.

- Payment frequency will align with payroll cycles.

- Contractors who are subject to Super Guarantee. Payday super rules apply – 7 days from payment of the contractor.

- Employees with their own SMSF will also require Payday super payments.

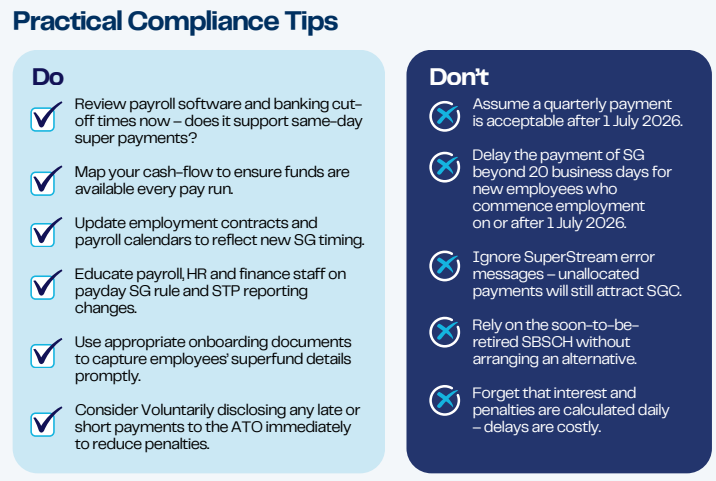

What Small Businesses Can Do Now?

There are practical steps that can be taken now to prepare for July 1st:

- Review payroll cycles:Weekly pay will require weekly super payments, and monthly pay will require monthly payments.

- Check payroll software:Confirm that systems can manage more frequent payments or identify suitable alternatives.

- Update employee super details:Ensure fund information is accurate and active.

- Plan for cash flow:More frequent super payments will place greater demand on cash flow.

- Stay informed:Monitor updates from the ATO as the reform progresses.

What’s Changing?

The ATO’s Small Business Superannuation Clearing House (SBSCH) will close permanently from 1st July 2026. This means employers will no longer be able to use the SBSCH to make super payments.

The updated SG charge–pay on time or pay more

If any contribution is not in the employee’s fund within 7 business days of payday, employers may incur an SG Charge (SGC) – even before the ATO issues an assessment.

- SG Shortfall: calculated on QE (not ordinary earnings).

- Post-assessment Penalty: 50% of any unpaid SGC outstanding 28 days after the ATO’s notice of assessment.

- Administrative Uplift: up to 60% of the SG shortfall, reduced by any late payments of SG to the employees’ fund and where you have voluntarily disclosed the late payment to the ATO.

- Daily Interest: general interest charges (GIC), which are subject to change, compound daily from the day after the due date. The current GIC rate is 10.61% annually.

- Late payments must still be remitted to the employee’s fund as soon as possible. Late contributions will automatically be allocated by the ATO to the earliest outstanding payday period. Prompt voluntary disclosure will reduce the administrative uplift and can minimise penalties